Lower Inflation, Higher Approval: Why a 2% CPI Could Reshape U.S. Politics

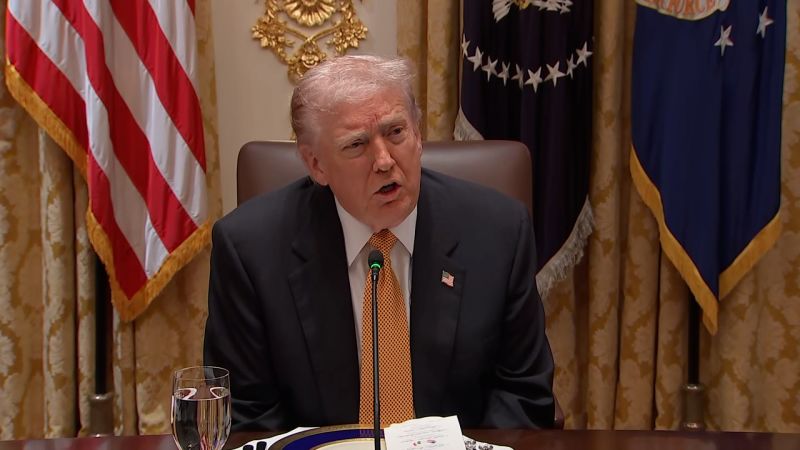

Bank of America’s senior strategist Michael Hartnett has stirred major political and economic debate with a new projection:

If U.S. inflation drops to 2%, former President Donald Trump’s approval rating could climb above 45%, potentially giving Republicans a decisive edge heading into the 2026 midterm elections.

Hartnett’s analysis, which examines the tight link between economic sentiment and voter behavior, suggests that falling inflation could dramatically shift the political landscape in favor of the GOP.

Economic Confidence = Political Confidence

For more than a decade, polling data has shown one consistent trend:

When Americans feel economically secure, presidential approval rises — regardless of party.

With inflation still a top concern for voters, a drop to the Federal Reserve’s ideal 2% target could signal stabilization in:

- Consumer prices

- Mortgage rates

- Grocery and fuel costs

- Small business confidence

- Household spending power

Hartnett argues that this psychological shift alone could push undecided voters toward Trump, especially those who leaned Republican in past cycles but expressed frustration during recent economic turbulence.

Why 2026 Midterms Could Swing Red

According to Hartnett, a 45%+ approval rating would give Trump something rare:

political tailwinds instead of headwinds.

Republicans could gain momentum in:

- House battleground districts

- Senate toss-up states

- Gubernatorial races in key swing states

- Down-ballot contests influenced by economic sentiment

Historically, the party with stronger economic approval benefits from higher enthusiasm and turnout — a pattern confirmed in elections from 1994 to 2014.

If inflation cools, Hartnett believes Republicans could replicate similar gains.

Investors & Analysts Watching Closely

Economic analysts, Wall Street strategists, and political scientists are monitoring three critical indicators:

1. CPI trajectory toward 2%

A soft landing scenario would fuel optimism across markets and among swing voters.

2. Federal Reserve policy outlook

If rate cuts arrive alongside low inflation, consumer sentiment could improve rapidly.

3. Household financial confidence

Survey-based indicators — often predictive of voting behavior — tend to shift with spending power.

As these data points trend positive, Trump stands to benefit, according to Hartnett’s forecast.

A Political and Economic Crossroads

Whether inflation hits 2% remains uncertain, but the implications are significant.

If Hartnett’s projection proves accurate, Republicans could enter 2026 with their strongest advantage in a decade — powered not by campaign messaging alone, but by economic reality felt at the kitchen table.

Voters consistently reward stability, security, and predictable economic conditions.

And if those elements align, Trump may find himself with approval numbers strong enough to reshape the midterm map.

Source: Yahoo Finance